Our employees write these stories and give you real-life examples of how we tirelessly defend our members.

Learn More About Our Memberships

How TaxAudit Helped One Family Reverse an IRS Denial and Secure Their Refund

How our team helped a member turn tax debt into a large refund.

Every year, thousands of taxpayers face unexpected IRS notices, audits, and refund delays.

Receiving a letter from the IRS can trigger instant dread.

When Bea and Marcus received a letter from the Oregon Department of Revenue, their hearts sank.

One of our tax professionals turned a daunting situation into a successful resolution.

Minho and Hannah successfully resolved their IRS CP2000 notice with the help of TaxAudit.

After two years and over thirty notices, TaxAudit members have a successful outcome.

How Our Team Helped a Member Save Nearly $15,000

A CP75 audit ends with the best outcome for one of our members!

Back in December of 2021, two of our members, Caleb and Sadie, received a notice from the State of Oregon.

The story of how one TaxAudit tax professional took a large amount due and reduced it from $40,000 to $150!

Our tax professional’s diligence and dedication turned a large tax bill into a refund.

Our experienced and dedicated tax professional resolved a case that resulted in a $3,000 refund!

Audit Defense members save $10,000 and learn to report mortgage interest accurately on future tax returns.

Our dedicated and hardworking tax professional successfully saved our Audit Defense member $12,000!

Our Tax Professional successfully appealed a CP2000 for an Audit Defense member who failed to report her late husband's income.

Our Audit Defense members received education on tax errors and how to prevent future mistakes, preparing them for success.

A Schedule E business audit ends with the best outcome for our Audit Defense members!

After receiving audit notices regarding their two businesses, our Audit Defense members saved $14,000 with the help of TaxAudit.

Expertise and hard work saved our members from paying $20,000 to the IRS!

Our Tax Professional resolved an IRS case involving double-reported income, reducing the amount owed from $30,000 to $0.

After receiving two IRS notices, our TaxAudit member went from owing $80,000 to $0!

Our Audit Defense member received two IRS notices for her Schedule C business. With help from TaxAudit, she ended up with a refund of $300!

Our Audit Defense member received two IRS notices for her Schedule C business. After reaching out to us, the Tax Pro on the case reduced her bill from $9,000 to

After receiving an IRS notice in July of 2023, our member reached out to us, and our Tax Pro had it taken care of and reduced to $0 after only 3 months!

One of our Tax Professionals supported our member for over two years – and their $55,000 in tax was reduced to nothing owed!

TaxAudit members had a diligent Tax Professional who was by their side for two years and through a tragedy.

Determination and dedication from one of our Tax Professionals ended with a couple receiving both an IRS correction and penalty abatement.

TaxAudit members had a dedicated Tax Professional on their side throughout a year-and-a-half audit.

Diligence and hard work saved taxpayers from owing the IRS over $350k!

TaxAudit’s Tax Professional worked hard to defend taxpayers against the IRS.

Niko received a letter from the IRS informing him that he owed over $600,000 in taxes. Then he remembered he had purchased Audit Defense and called for help.

After two years of battle, TaxAudit saved their member from owing the IRS over $50,000!

Eric received a letter from the IRS stating that instead of owing the $9,700, he would actually receive a refund of over $800.

Our client received a CP2000 notice from the IRS stating that he owed them over $360,000 for some discrepancies on his tax return.

At TaxAudit, we strive to do whatever it takes to make sure that our members are only paying what is rightfully owed.

TaxAudit took a $25k amount owed and turned it into a refund of over $2k!

Jenna received was a CP2000 notice stating that the income she reported for 2020 did not match the income that had been reported to the IRS.

TaxAudit's Tax Professional assisted a taxpayer with only days remaining to respond.

TaxAudit helped save a taxpayer $18,000 while also helping them understand a Schedule C as a truck driver.

With the help of one of TaxAudit's tax professionals, a military reservist was able to claim all of his tax deductions!

TaxAudit members receive continual support throughout their multi-year audit of their Schedule C.

TaxAudit’s dedicated Tax Professional quickly turned a $50k proposed amount due into a refund!

After countless stall letters and proposed amounts due, TaxAudit’s Tax Professional achieved a best-case resolution for their member!

TaxAudit’s Tax Professional helps turn a balance due to a refund received!

Our tax professionals didn’t let the holidays get in the way of providing first class service to our members!

TaxAudit tax professionals delivered excellent customer service to our members in the month of November!

As we head into the end of the year, we cannot help but be thankful for all our wonderful members!

TaxAudit worked diligently to make sure their members received top-notch customer service in September!

A TaxAudit Tax Professional spent three years fighting for her member.

TaxAudit’s Tax Professional worked diligently to help a member in need.

A TaxAudit member went from owing $22,000 in tax to receiving a $1,000 refund!

A TaxAudit tax professional worked with their member to bring their $35,000 balance due down to just $340!

TaxAudit’s tax professional worked diligently to ensure that their member was only paying what was rightfully owed to the IRS.

TaxAudit’s tax professional worked with his members to make sure that, not only did they not owe the IRS additional tax – but they were actually due a refund!

TaxAudit tax professionals take the time and attention to understand a taxpayer’s unique situations and handle their cases with kindness.

TaxAudit took stress out of an already stressful year to help support their member.

The TaxAudit team showcases their collective expertise to assist a member through a "claim for refund."

Clear instructions and an honest conversation led to a best case scenario for a TaxAudit member.

TaxAudit's tax professional helped solve an education credit issue that dropped the amount due to the IRS from $5,000 to $535!

By going the extra mile, our tax professional changed a balance due to a substantail refund!

Through her hard work, determination, and diligence, a tax professional reduces a member's tax bill by nearly $25,000.

TaxAudit challenged an IRS examiners position that was based on decade old court cases to save their members from owing a $30,000 tax bill!

TaxAudit’s Tax Professionals have risen to the challenge of working from home by making sure our members are still being taken care of.

TaxAudit team members are incredibly thankful for their IT Department during these challenging times!

TaxAudit worked diligently to defend a taxpayer's federal and state return which resulted in a refund being due back to the taxpayer!

TaxAudit proved to the IRS that a taxpayer had properly reported income, assuring that he was not responsibile for paying the proposed balance due.

TaxAudit worked relentlessly for almost three years to get the refund that was owed to taxpayers!

TaxAudit assured that a taxpayer successfully received the Earned Income Credit and Child Tax Credit they were owed.

TaxAudit successfully defends a taxpayer who received an audit notice for a business bad debt deduction.

TaxAudit's member explained that the service and representation he received had cleared up any doubts.

One often overlooked challenge that comes with opening a business is how our taxes will be impacted.

When we rallied together this tax season, we demonstrated all three values – day after day, time and time again.

A simple transposition of numbers, or even a misplaced decimal point, can cause a taxpayer a great deal of stress and well, money. Read how we helped one couple

Over the life span of the case, we remained in near constant contact, as evidenced by our 38 separate communication exchanges since the audit first began.

The member's IRS notice had balance due of $168,972.64 and eventually received a letter from the auditor with a balance due of $0.00!

The members went from owing $53,316 to a $40,615 refund! That’s a $93,931 swing in circumstances.

With several years of audit representation experience under her belt, Judee was ready for anything that came her way when she received a small business audit.

When I shared the good news with the member, she expressed such gratitude that we had gone to battle for her and spared her more than $3,000 of additional tax.

The taxpayers were being overcharged by more than $7,000 in tax, penalties, and interest. Our member was very appreciative and asked me to get it corrected.

As audit representatives, we are required to review our members’ tax returns in full, for other potential issues that could possibly be flagged by the IRS.

Our annual low-cost memberships cover our members with income tax audit representation whether it is one or more audits − all for the same low price.

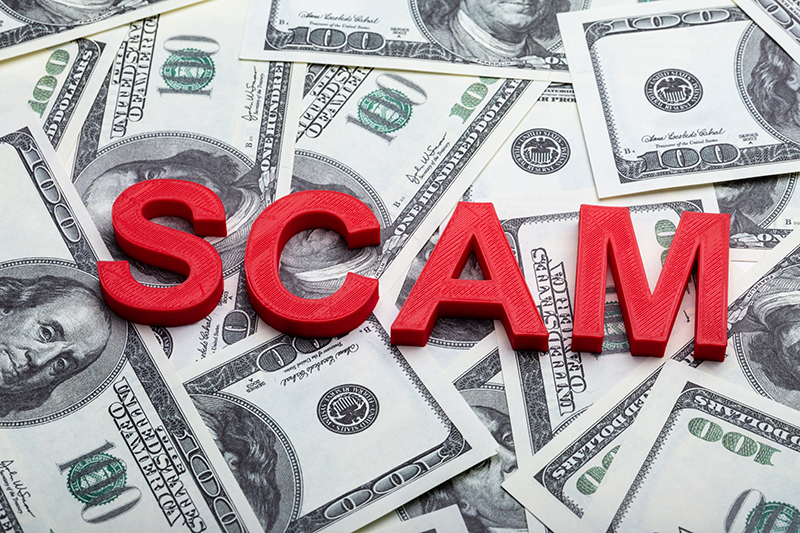

The member had come into the bank in a frantic state. He explained that if $8000.00 wasn't wired to the IRS immediately he would be detained.

This story is about a phone call that saved my member over $98,000. My member received a letter from the IRS that was very vague.

At the start of a case our members’ issues become our own, and we represent them with the same level of tenacity that we would put forth for ourselves.

The very reason TaxAudit exists is to help others. We live out our mission by protecting and defending our members − from unjust audit outcomes.

In this case, the members were thrilled with the outcome, as it had far exceeded their expectations.

At TaxAudit, each of our audit reps carry with them knowledge, experience and an unwavering desire to help people.

Our Information Technology team plays a critical role in the service we provide to our members, and in our ability to provide it.

When she was recently assigned a case proposing that a member owed over $1,000,000, she knew something was amiss.

Recently, TaxAudit adopted a new technology to enhance our members’ experience with us. This software allows us to assist them more efficiently.

Tackling the IRS on behalf of our members is not something to be taken lightly. I attend to every case with a fresh set of eyes.

In our line of work, the smallest of details can make the biggest difference for our members. In this case, a little bit of teamwork went a long way.

After receiving a notice from the IRS questioning his $16,704 medical deduction, the member knew he had to contact our team at TaxAudit.

David correctly analyzed the situation and provided the rep with the information necessary to get an almost $8,0000 adjustment for the member.

A decision arrived from the IRS. It was good news: they agreed to remove the failure-to-file penalty! Both Judee and the member were thrilled.

Our member received a CP2000 notice showing he owed the IRS over $200,000! We believed we could defend him based on this section of the IRC.

He was desperate to get his case solved before that time. He was even willing to just pay the IRS so he could be done with it.

We showcase what TaxAudit.com is all about; this is where we have the opportunity to truly make a difference in the lives of our members.

As a Membership Services Representative at TaxAudit.com, I have the opportunity every day to make a difference in the lives of our members.

Through my continued determination on my client’s case, combined with my member’s patience, we were able to finally correct the IRS’s uncompromising stance.

Our Audit Coordinators are there to help our members have a smooth experience sending in their initial documents.

While I have worked on many cases over the years, there is one case in particular that stands out to me – one that I believe is worth sharing.

Each of these three IRS letters reflected a zero balance due. The member could not have been happier.

We closed the case with a zero balance due. This was so much better than the $38,000 that the member was originally going to owe, and she was thrilled.

The IRS agreed to release the member’s refund check on July 8, 2016 in the amount of $61,890.62.

Not only was I able to assist an 80-year-old widower, but I was also able to help prevent him from paying taxes he did not rightfully owe.

What do Robin, Samwise Gamgee, Dr. Watson and the Audit Department Assistants of TaxAudit.com have in Common?

A few weeks later, we received a new notice for 2012 which removed the penalty. When I called the member, she was so appreciative.

One of our company goals is to provide the best taxpayer education available to our members. One way we empower our members is through knowledge.

In my environment we deal with complex government regulations, but he managed to explain the IRS complexity and requirements as easy to understand.

All of us at TaxAudit.com recognize how much of an impact a timely response can have on the confidence and stress levels of our members.

With my audit defense strategy and his documents, we were a power duo with a hit.

Resolving the case had taken five-hundred and sixty-six days from beginning to end. Persistence paid off once again.

The TaxAudit member will receive a refund of $9,515.42. Needless to say, she is thrilled with the result.

The member was extremely relieved and grateful for our service. I received notification that the inquiry was closed with no change to the taxpayer’s return.

After more than two years, finally the case has been closed and the member’s tax liability went from a high of $269k to a final number of $23K.

She had received a new notice with a zero balance due. She could not have been more satisfied with the outcome and thanked me over and over.

I told him to focus on taking care of his health, and we would do our best to take care of the IRS issue for him.

Today, I could not be more grateful that I had the pleasure of being on the receiving end of this phone call. The woman just wanted someone to listen to her.

They were thrilled that they would have the opportunity to file amended federal and California income tax returns for the open years.

The taxpayer received a “no change” notice in January, which means she owes the IRS nothing. Needless to say, the taxpayer and her son are extremely relieved.

Often when assigned new cases, we find members who have made what initially appear to be insignificant errors and end up owing substantial amounts of tax.

It only took a year plus one month to clear up the problem, caused by the taxpayer being honest and wanting to return the fraudulent check to the IRS.

The IRS sent a letter announcing that they did not make any changes to the tax reported on the original return. We won the case, and the member was thrilled.

The member was very thankful for our services. He sent us a huge box of Harry and David goodies that we enjoyed for months.

TaxAudit treats members with the very best customer service available while treating them with empathy and respect during a very stressful situation.

TaxAudit's Customer Service Reps work tirelessly to reduce our members’ anxiety during one of the most stressful experiences of their lives.

When members call the Membership Service Department, they have received a letter from the IRS. It is the worst nightmare of many people.

It’s not often that a taxpayer can disregard a court order, but a recent audit showed one of those rare instances.

I just worked a challenging case involving a discrimination lawsuit settlement that one of our members received as a former employee.

The examiner had called Tan to let him know that she was closing the case with no changes or adjustments.

Trouble came when the IRS sent him a letter contending that he had not included the value of the prize on his tax return.

He’d invested almost the entire contents of his 401K − over $50,000 − into unregistered securities. The securities were movie production investments.

We may be exceptional number crunchers at TaxAudit.com, but we are also empathetic communicators.

My story began in May of 2011 when the Canada Revenue Agency (CRA) was inquiring about the education expenses of my member.

As Audit Rep Assistants, we perform many tasks, such as recreating tax returns, completing bank analyses and preparing response packages for the IRS.

The taxpayer had an amended return prepared and we submitted it to the Taxpayer Advocate. The IRS agreed and released the Member’s recalculated refund.

The Revenue Agent conducted the audit by correspondence, which was unusual. He did it that way because it had originated from a related corporate examination.

The Member was living in Southern California in a large beautiful home when she received a “check a box” audit for mortgage interest paid.

was able to get the case reviewed by the Taxpayer Advocate Service, and they were able to get the case re-opened and assigned to an Appeals Officer.

One of the biggest promises we make is to handle all contact with the IRS so our Members don’t have to.

The focus of the notice was Cancellation of Debt and missing Social Security income. Both of the 1099-C forms listed on the notice were related to a short sale.

I have thought often about how my colleagues and I are like SUPER HEROES, making a difference every day in the lives of the people we defend.

The IRS Revenue Agent had already determined that the Member’s business restoring classic automobiles was not a valid business, but a hobby.

He tried to obtain a loan for his business from a company in Brazil. Unfortunately, the company was in the business of scamming people out of their money.

He had reported wages of $80,376 from a job as a commercial diver and a deduction against that income of $47,501 for unreimbursed employee business expenses.

The Members had claimed a $15,662 passive activity loss on Schedule E. Their modified AGI was $178,330 so it was not surprising that the IRS had questions.

Sometimes faith in what’s right pays off. This was the case for a recent adoption credit examination we defended for one of our members in Wisconsin.

I was assigned an Arkansas Department of Revenue audit. When I reviewed the file, the taxpayer’s name and place of residence seemed familiar.

The following story is about the exceptional service provided by a TaxResources team. With more than five tax professionals on the case.

Audits can be time-consuming, stressful, and serious. When members first contact us for assistance, they can be panicked or confused about where to start.

When I was assigned an audit for Schedule A charitable contributions and medical expenses, I knew this would be a challenge.

High deductions for employee expenses are a frequent audit target, especially when they relate to education. The rules are strict and it isn’t easy to qualify.

Our member was being audited for excess mortgage interest. This was the result of using the Married Filing Separately (MFS) filing status.

Determining whether you have a business or hobby can be confusing, and it is not always clear cut. It has also been the basis of many audits.

The audit was focused on the members’ businesses and itemized deductions. They tried to handle the uncovered year on their own and had met once with the IRS.

The audit was focused on the Schedule C for self-employment and a Form 1099-A cancellation of debt.

Over the many years she’s been representing our members in IRS office audits, Susie has learned a lot about reading a situation and achieving the best outcomes.

A Notice of Deficiency is the last letter sent to taxpayers by the IRS to address a tax balance due, which is also called a ”deficiency” in IRS speak.

A Schedule C for self-employment with no income and a $16,000 loss will easily draw the attention of the IRS. This was exactly the scenario for this member.

I worked with a member who had experienced a significant business theft and then, as bad luck would have it, she was audited by the IRS.

The member received a notice questioning her IRA rollover of $212,000 from 2008. The notice included a bill for $62,271, plus penalties and interest.

One of the most difficult challenges we face when dealing with an IRS audit is arguing that a business is a ‘for profit’ activity instead of a hobby.

One of my most recent exciting cases started out with one our members receiving a bill for $434.79 when she was expecting a refund of nearly $7,000.

Before you decide to handle your own IRS audit, you should be alert to all that could go wrong if you do.

The members, a married couple, received a letter from the IRS requesting information to substantiate the medical expense deduction reported.

There are certain times in life when an IRS audit is unavoidable like when certain items on your tax return do not match the IRS numbers.

Taxpayers who handle their own IRS audits frequently find the experience so confusing and stressful that they’ll write a check to the IRS to make it go away.

This month’s case shows how an Audit Representative from TaxResources can be the coach and the game-changer you need to win your audit.

This month’s case shows how an Audit Representative from TaxResources with lots and lots of practice gets you through an audit with ease.

The members received a notice from the IRS with a proposed balance due of $84,500 for the 2008 tax year, an amount more than three times their annual income.

This month’s case shows how a TaxResources audit representative with an up-to-date education provides the defense you need to win your audit.

The IRS was disallowing all of their itemized deductions, including medical expenses, charitable contributions, employee business and investment expenses.

After uncovering widespread homebuyer credit fraud, RS examiners have been known to disallow legitimate claims. That is exactly what happened in this case.

This case illustrates how having an audit representative makes dealing with the IRS a whole lot easier, even when all that’s requested is something simple.

The audit came in as a Notice of Deficiency (NOD), which means the member had received at least two letters previously but had done nothing to address them.

The received a 1099-R from their financial institution, and when reporting their retirement plan distributions, rollovers, and transfers, but made a mistake.

Never assume that an IRS letter, bill or notice is correct: each item, figure, and computation should be checked for accuracy.

This month’s case shows how having an audit representative who stays current with latest tax developments can be essential to winning your case.

The taxpayers received a bill from the IRS for retirement plan income that they had failed to include on their tax return three years earlier.

When he received the closing letter showing no balance due, the member called to tell the Audit Representative how happy he was the case was finally closed.

The taxpayer received a bill from the IRS for more than $2,000, which included a ten-percent early withdrawal penalty on a retirement plan distribution.